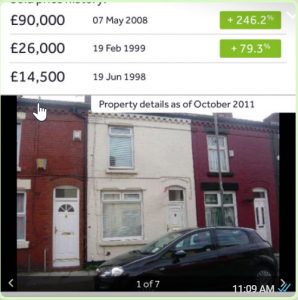

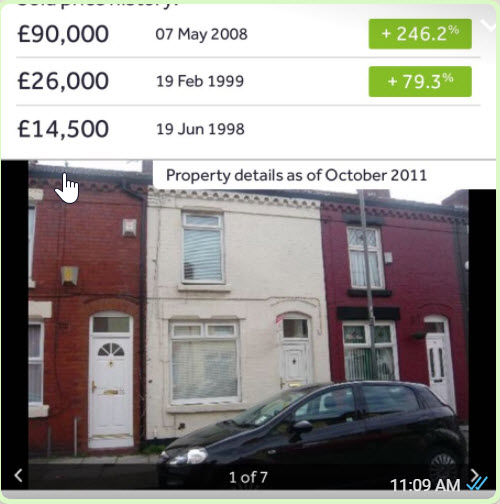

Everyone seems to want a bargain in UK Property…More so, they want high yields…Even more interesting at least to me is that investors from outside the UK think they can manage and run refurbishment projects. Maybe they can…I just know all the issues we go through on a daily basis. Besides sourcing and providing High Yielding Professional and Social HMOs we are looking in markets where prices have collapsed from the highs of 2008. Our goal is to source….tenant….manage….Keep some….sell some as turn key properties around the 9-10% range that are mortgage able. We hope to pay down a mortgage with capital repayment….deduct the interest as long as the HMRC does not change anything with that….and cash flow brilliantly. The best part if there is appreciation once again. We have identified two markets in the North in which we will be buying 2 properties in each & testing the waters. This is a property we will be viewing. We are hoping to be in the low 40k range…allowing also for refurbishment. Double digit rental yields. It will not be easy….yet my JV colleagues have approx 50 properties in which they own & tenant with LHA tenants. Many landlords do not like LHA however during the last property crisis, the councils continued to pay while many working tenants lost their jobs & were unable to pay their rent. As always, nothing easy with property. A lot of hard work and alot of patience. My colleagues know a gent who used this model, built up several hundred properties & then sold in 2005. Now he is sitting back & doing guaranteed rent Social housing with the profits. Being at the right place…right time with enough money.

Recent Comments