Due Diligence For Property Investors

There is the old saying, you make your money in property when you buy…..However not doing your due diligence right on your property purchases you can blow your budget and lose money very fast. When doing your due diligence, it is paramount to do it correctly and thoroughly.

Giving a short example, we spoke to a London architect regarding a conversion. He showed us a Church conversion in Ashton under lynn. We immediately got a sense of the numbers and realized the investor doing this conversion was not going to make any money at best and probably lose money. They did not cost out various issues, leave room for contingencies as well as over priced both the sales price or fall back plan on rents.

Thus a good purchase seems to go into the Bin. However there are more things with Due Diligence.

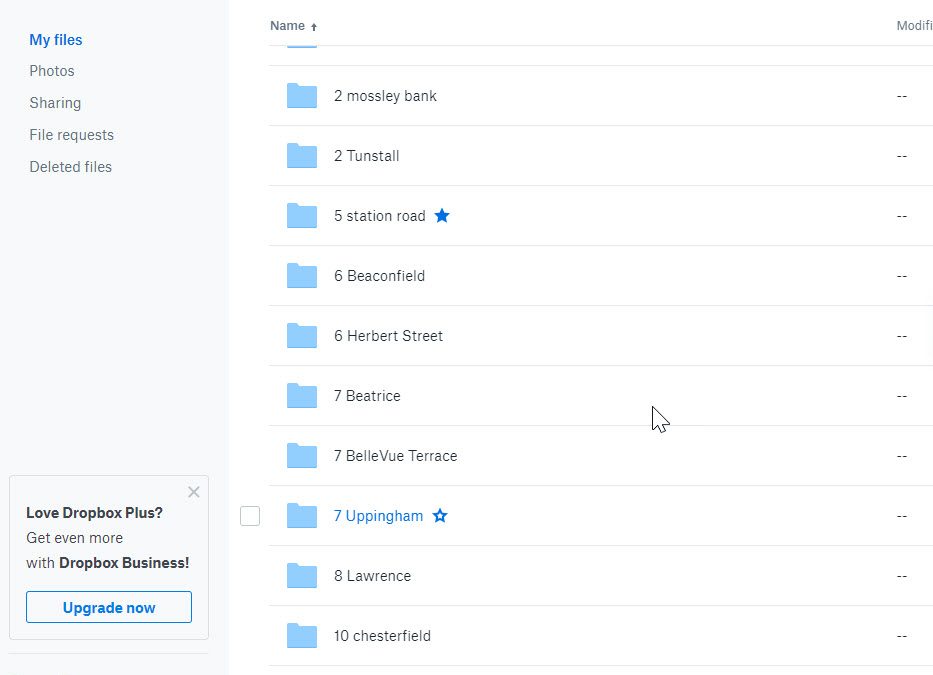

Rule #1: Make sure all communication is in writing. Whether the communication is through your broker, the seller’s broker, the seller, the attorney or the garbage man—put it in writing. Save all your emails. Save every file in Dropbox or an equivelant.

Rule #2: Itemize all needed documents in an addendum to the purchase contract or LOI. Stipulate when each document is due and specify the dates for walking all units and the entire property.

Rule #3: As you start this process, build out a “folder” on the deal. The folder that you use to store every document. We use dropbox and can share it amongst ourselves. With a good organization system, you won’t waste time searching for lost materials or ask the seller to provide them again. We put everything from EPCs to Memo of Sales to floorplans etc.

Rule #4: Build out your own P&L and expenses to operate the complex. Review what has been provided to you, but assume every number is wrong until you verify it with proper documentation. If you can’t verify a number, then you will need to research and find a way to verify it. If you still can’t verify a number, then increase that number by 50% to cover yourself for any unexpected contingencies. Doing this will prevent the above real life example I said regarding the church conversion.

Rule #5: Determine the real cost to renovate and stabilize the property. If you don’t feel comfortable with this process, consult with someone who can help you. AGAIN….Reiterating the same thing. Check and recheck your numbers. Surprises will happen.

Due diligence will make you or break you! Due diligence is CRITICAL to your success as a real estate flipper or investor. Done well, and you can operate a successful business. Not done well, and it could be the NAIL in your coffin. The time when you are purchasing and flipping a property is your time to identify all of the issues and problems at hand.

What do you think?

Recent Comments