China is in “Biggest Bubble in History” What About the UK?

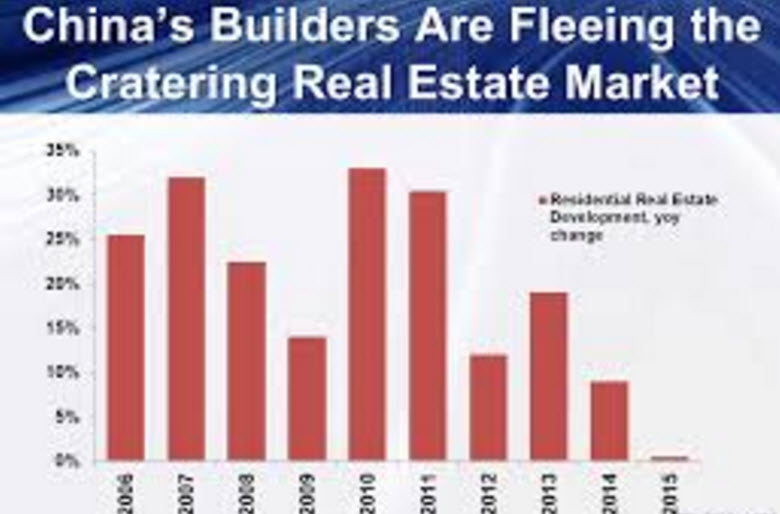

There was an article floating around in which Wang Jianlin who is a billionaire from China stated that China is in “Biggest Bubble in History” .

As per Forbes business magazine, Wang Jianlin is the richest man in China, and his real estate business brings in about $44 billion per year — but he has been gradually cutting back on his own personal allocation to real estate due to what he sees as a volatile market or real estate bubble.

“I don’t see a good solution to this problem,” he said. “The government has come up with all sorts of measures — limiting purchase or credit — but none have worked.”

One can easily add the real estate bubble in Vancouver or maybe even London. No one has a crystal ball, however I believe there are warning signs. Virtually everyone I speak to buying UK real estate thinks of how much they can borrow. The more the better. Interest only is even better. Prices only go up. Sure. I have lived through 3 real estate crashes in the US. First in the 1980s when interest rates sky rocketed, 1994 when interest rates spiked and in 2007 ( just alot of cheap money). Today might be different in the UK real estate market as banks are making it tough to get loans…alot of hoops to jump through…but still most think of how much they can borrow.

I am very conservative by nature. I avoided 2007 crash ( actually closed my bridging company, stopped building houses and stopped refurbishing all in Jan 2006). I am concerned about the worlds state of economy, from student loans in the US to a bubble real estate market in China. We are late in the cycle potentially.

However this does not stop me from investing in the UK. Myself and my JV partners just try to invest smartly and cautiously. We only buy…not good deals…but GREAT deals. One example we just bought a property to convert into 5 en suite HMO. The seller bought the property 12 years ago and paid 115,000. We bought it a couple of weeks ago for 84,000. Even if the market goes down we have insulation. More so we feel that HMOs in a bad economy still will flourish. A professional HMO is a cheap way for someone to live. All bills included. From my standpoint and my JV partners, we create a cash cow. We are not leveraged and even rents did not go down in the last crash. People need to make money somewhere. Selling tenanted cash flowing Professional HMOs offers the potential to investors looking for cash flow. The alternative are rather bumpy…stocks…bonds( no returns) or who knows what. The brick and mortar properties in and around Manchester in which we buy have been before us a 100 years and will be 100 years after us.

Professional HMOs yield much more than the typical buy to let. I am sure you know this already…In my personal opinion, even in a bad economy…a professional HMO should cash flow and offer a safer alternative to other investments….Keep leverage manageable however…

What do you think?

Recent Comments