People really do not fathom how bad an economy can get. Not being negative, my personal shocker was watching the Nasdaq in the 2000 period. I have been involved in real estate in the 1980s, early 1990s as well as 2006. Most real estate investors I know or meet always tell me the same thing: prime cities can’t go down! It does not matter if it is New York, London, Paris, San Francisco, Vancouver, Singapore, Sydney – they’re all solid! I remember finishing college and reading how real estate investors were throwing the keys back to the banks in New York City in 1982.

It does not matter if it is a stock market bubble or a real estate bubble, bubbles that create such extreme wealth don’t last. Their wealth tends to get cut in half in the years and decades to follow. This has devastating consequences to the real estate prices in huge cities where these global elite park their money. They see such cities as the safest place (London) to park large amounts of money. Where else can you buy a 4,000 to 9,000 square-foot penthouse for $20 to $120 million?

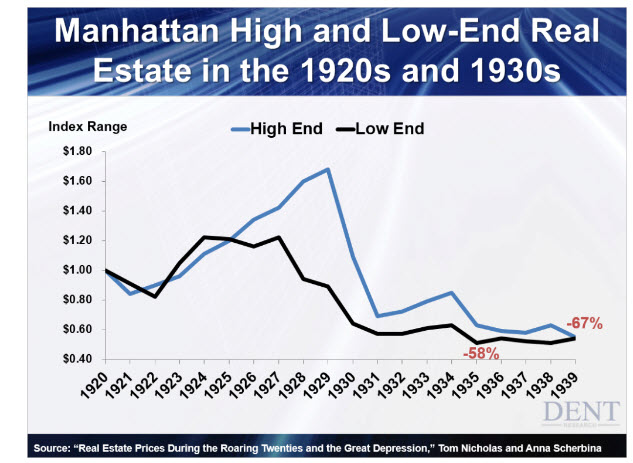

But here’s what that assumption might cost them by simply looking back at history. This chart shows how Manhattan – the greatest district in the great city in the world! – fared in the Roaring 20s… then the Great Depression…Or how about Japanese real estate investors in the 1980s?

The high-end peaked the latest (and most dramatically) in 1929, then crashed 67% into 1939. That’s twice what the average house fell by from 2006 to 2012. Simple – the greater the bubble, the greater the burst! The question is, who’s buying these properties at such outrageous prices (London)? Buyers on the highest end are often foreigners just looking to get a stake and park (or launder) money out of their country – they more often than not don’t really live there.

We invest in Manchester. Manchester had somewhat of a bubble, yet today prices are not just coming back to 2007-2008 levels. When we invest, we always look at the worst case scenario. We look at PLAN B. We do not like leverage. In 2006 I stopped all my real estate activities in the US. Prices just got too crazy. I feel the same in London. It is a personal opinion however. I like the yields and ROI in Manchester. We feel we are somewhat insulated for any unexpected economic shocks. People have to live. We specialize in HMOs. The wonderful aspect of HMOs are they are affordable. More so, we prepare them to a high standard so it is affordable luxury. Parallel to our Professional HMOs we do Social Housing HMOs in which we rent to the contract holder for the North West from the Home office for social housing. These people also have to live somewhere. They do not collect a paycheck. They can not be turned out. More so in a bad economy there will be more need. The point of my post is that anything can happen. Too many real estate investors do not believe that prices can fall further than the recent 2008 debacle.

Recent Comments